Morning View

In the United States, ADP employment data surprises slightly on the upside

International

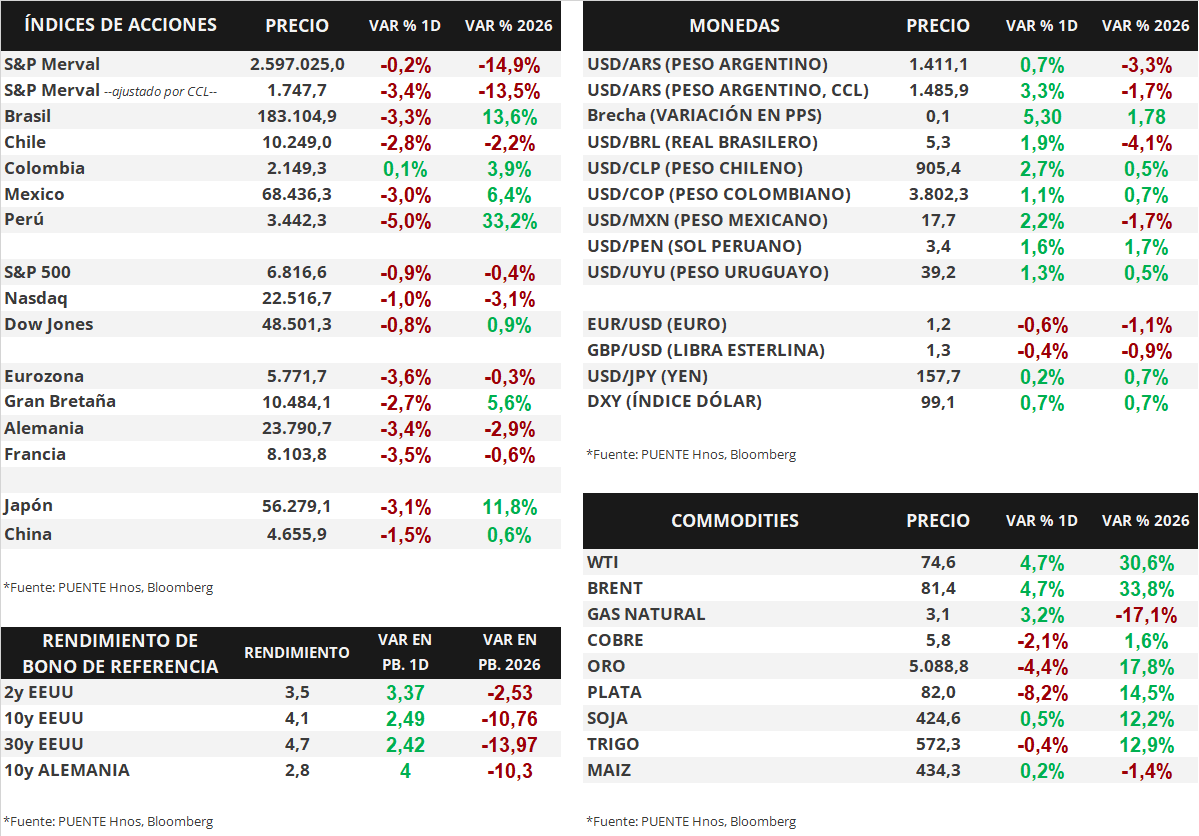

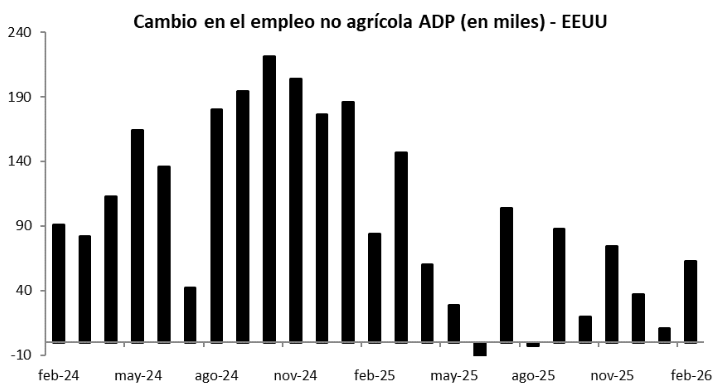

In the United States, yesterday saw the publication of employment data from the private agency ADP, which recorded the creation of 63,000 jobs in February, above the expected 50,000. This data serves as a preview of the official employment data to be published on Friday. On the other hand, the Purchasing Managers' Indices (PMIs) for services for February were also published. According to S&P Global, the measurement was 51.7 points, slightly below the 52.3 projected by the consensus of analysts, although according to ISM, the measurement was 56.1 points, above the 53.5 expected in this case. We remind you that a measurement above 50 points implies growth in activity compared to the previous period, and below 50 points implies a contraction.

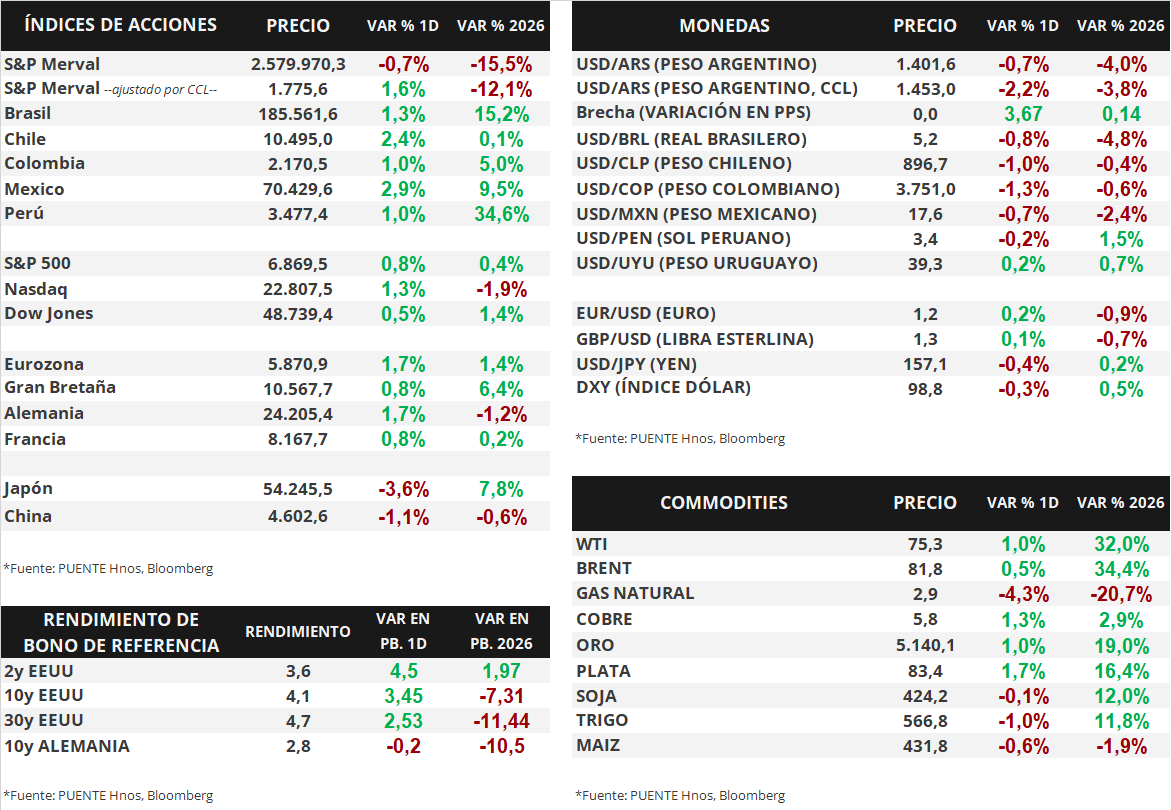

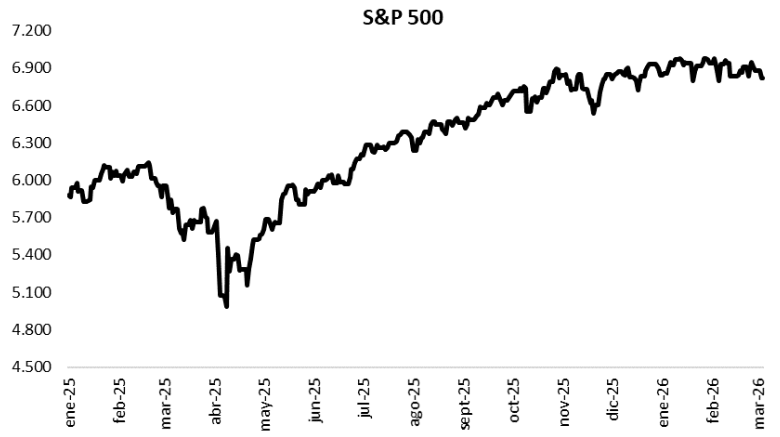

The main US stock indices advanced across the board yesterday. The S&P 500 gained +0.8%, returning to positive territory in 2026, while the Nasdaq advanced +1.3% and the Dow Jones +0.5%. So far this year, the indices have accumulated variations of +0.4%, -1.9%, and +1.4%, respectively.

Finally, with regard to US Treasury bond yields, the curve widened again yesterday. The 1-year bond yield rose from 3.54% to 3.57%, while the 3-year bond yield stood at 3.56%, up from 3.51%. Meanwhile, the 10-year bond yield rose from 4.06% to 4.09%.

Source: PUENTE Hnos, Bloomberg

In the United States, stock indexes fell on Tuesday

Internacional

In the United States, the main stock indices fell yesterday in a session marked by high volatility. The S&P 500 closed down 0.9%, the Nasdaq down 1.0%, and the Dow Jones down 0.8%. So far this year, they have accumulated variations of -0.4%, -3.1%, and +0.9%, respectively.

This morning, wholesale inflation data for the Eurozone was released, standing at +0.7% monthly for January, above the expected +0.2%, and the year-on-year measurement showed a decline of -2.1%, also exceeding the expected -2.6%. In turn, January unemployment was 6.1%, below the 6.2% projected by the consensus of analysts.

Finally, with regard to US Treasury bond yields, the curve continued to widen yesterday. The 1-year bond yield rose from 3.53% to 3.54%, while the 3-year bond yield rose from 3.48% to 3.51%. The 10-year bond was no exception, with its yield rising from 4.03% to 4.06%.

Fuente: PUENTE Hnos, Bloomberg