Weekly Reports

Weekly Markets Report

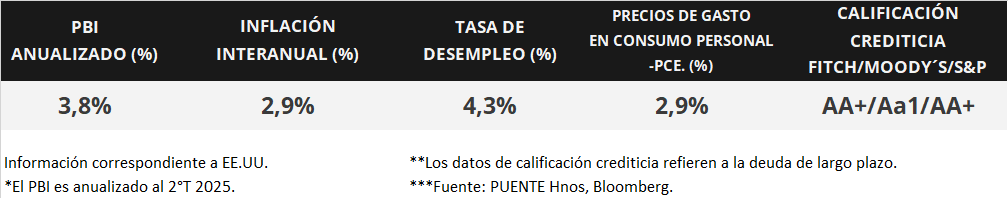

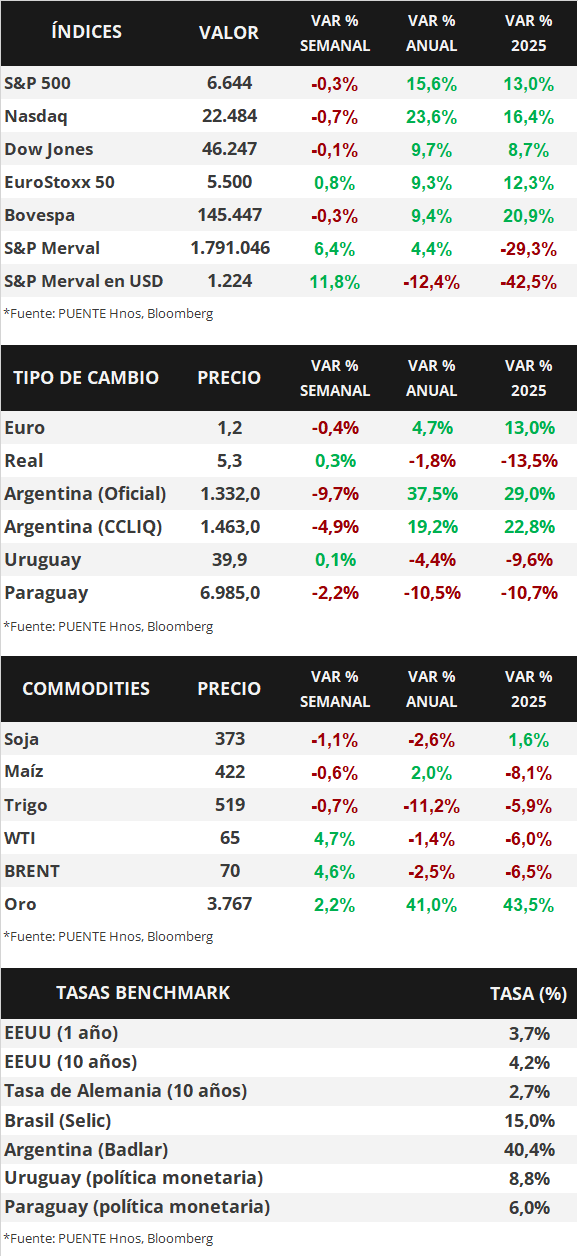

In the United States, the federal government entered into a partial shutdown at the beginning of the month after the Senate rejected the short-term funding bill, which has meant that some agencies have been left without resources to operate and others have had to reduce their operations. This has led to a delay in the publication of September employment data scheduled for last week. In this environment, the main stock indices reached new all-time highs across the board, while US Treasury bond yields compressed across the curve, with the 1-year bond at 3.63% and the 10-year bond at 4.12%. This week, attention will be focused on the release of the minutes from the latest Federal Reserve (Fed) meeting, while September labor market data is also expected, with an estimated 51,000 new jobs created and an unemployment rate of 4.3%. Given that the benchmark rate remains at historically high levels (currently at 4.25%) and is expected to continue falling in light of the weakening labor market, this results in higher nominal yields today than those that could be obtained in the coming months for investment-grade bonds, making it appropriate to position oneself in tranches of less than 5 years in duration due to their lower sensitivity to changes in interest rates.

Weekly Monitor

International

This week in the United States, attention will be focused on the release of the minutes from the Fed's last meeting, at which the first cut of the year was made to the benchmark rate, bringing it down to 4.25%. At the same time, September labor market data is eagerly awaited, with estimates pointing to the creation of 51,000 new jobs and unemployment at 4.3%. These figures have been delayed by the partial shutdown of the federal government. In the Eurozone, the minutes of the European Central Bank's September meeting and the evolution of August retail sales—a proxy indicator of activity—will also be released. In Latin America, September inflation figures will be released in Brazil, Chile, and Mexico, with year-on-year increases estimated at +5.2%, +4.4%, and +3.8%, respectively.

The US federal government entered into a partial shutdown at the beginning of the month, something that had not happened since 2018, after the Senate rejected the temporary funding bill, which would have allowed the current operation to continue until the annual bill was approved. This lack of consensus between Republicans and Democrats has meant that some agencies are almost completely shut down and others have reduced their operations.

For this reason, the September employment data scheduled for release last week was not published. However, the national employment report from Automatic Data Processing (ADP) for September was released, showing a loss of 32,000 jobs, when 52,000 new jobs were expected to be created.

Against this backdrop, US Treasury bond yields compressed across all maturities, with the 1-year bond falling from 3.66% to 3.63%, the 3-year bond from 3.65% to 3.59%, and the 10-year bond from 4.18% to 4.12%. Investment-grade corporate bonds (ETF LQD) closed with an average yield of 5.2%. In the equity segment, the main US indices extended their upward trend, reaching new all-time highs in all cases during the week.

In the Eurozone, preliminary inflation for September was in line with estimates, posting year-on-year increases of +2.2% and +2.3% in the measurement that excludes food and energy (core), while the monthly comparison was +0.1% in both cases. Meanwhile, in the United Kingdom, second-quarter gross domestic product (GDP) was released, advancing +1.4% year-on-year, above the expected +1.2% and previous performance.

Weekly Markets Report

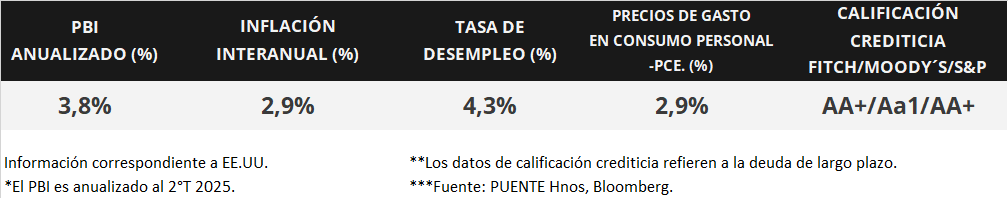

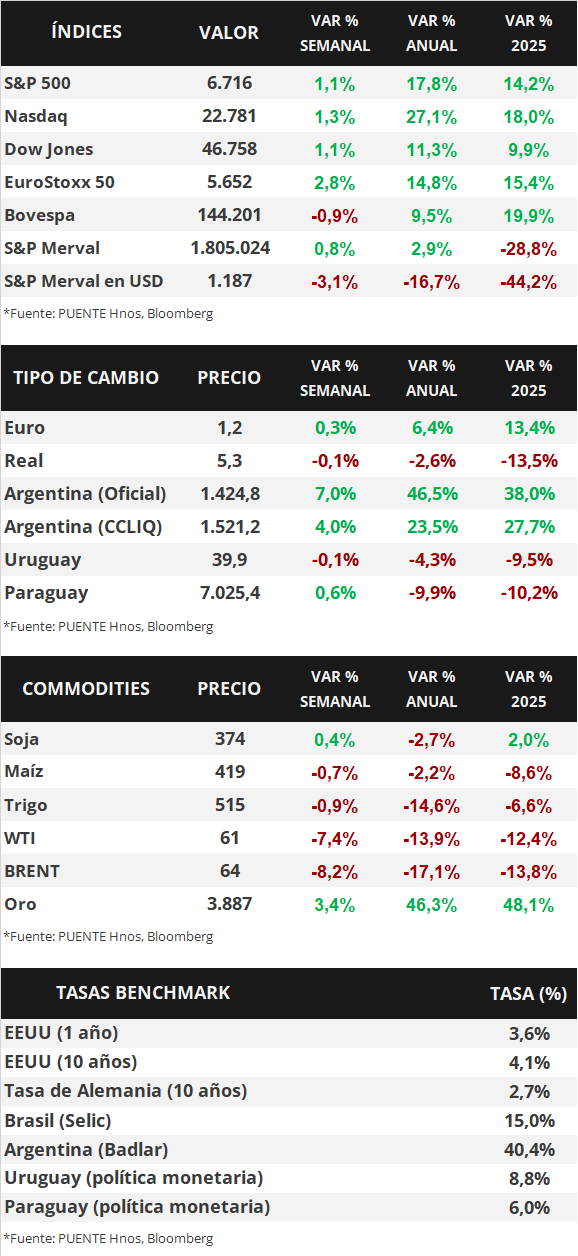

In the United States, the personal consumption expenditure (PCE) price index—the Federal Reserve's (Fed) preferred measure of inflation for monetary policy decisions—rose 2.7% year-on-year in August and 2.9% in the measure that excludes food and fuel (core), in line with expectations. Meanwhile, second-quarter gross domestic product (GDP) grew at an annualized rate of +3.8% according to the final estimate, exceeding analysts' consensus forecast and contrasting with first-quarter performance (-0.6%). In this environment, the main stock indices reached new all-time highs across the board, while US Treasury bond yields widened across the curve, with the 1-year bond at 3.66% and the 10-year bond at 4.17%. This week, the focus will be on September labor market data, with unemployment estimated at 4.3% and the creation of 48,000 new jobs. Given that the benchmark rate remains at historically high levels, and with expectations that it will continue to fall in response to the weakening labor market, this results in higher nominal yields today than those that could be obtained in the coming months for investment-grade bonds. It is therefore appropriate to position oneself in tranches with maturities of less than 5 years due to their lower sensitivity to changes in interest rates.

Weekly Monitor

International

This week in the United States, attention will be focused on the evolution of the labor market in September, with an estimated 48,000 new jobs created and an unemployment rate of 4.3%. This data will be key ahead of the Fed's next meeting in October, as it would indicate a continued weakening of the labor market. In the Eurozone, preliminary inflation figures for September will be released, with expectations of a year-on-year increase of +2.2% and +2.3% in the core measurement; while in the United Kingdom, second quarter GDP will be published, with expectations of +1.2% year-on-year.

In the United States, the August personal consumption expenditure (PCE) price index—the Fed's preferred measure of inflation for monetary policy decisions—was in line with analysts' consensus expectations, posting +0.3% monthly and +2.7% year-on-year, while the core measure advanced +0.2% monthly and +2.9% year-on-year.

In turn, second-quarter GDP grew +3.8% annualized according to the final estimate, exceeding the expected +3.3% and representing the best performance in almost two years. This performance, which contrasts with that of the first quarter (-0.6%), is due to the significant increase in private consumption (+2.5%) and the decline in imports (-29.3%) following the advance purchases made in the first quarter prior to the setting of tariffs.

In this context, US Treasury bond yields widened across all maturities, with the 1-year bond rising from 3.58% to 3.66%, the 3-year bond from 3.56% to 3.65%, and the 10-year bond from 4.13% to 4.17%. Investment-grade corporate bonds (ETF LQD) closed with an average yield of 5.3%. Meanwhile, the main stock indices ended the week with slight declines, although they reached new all-time highs in all cases at the beginning of the week.

In the United States and the Eurozone, the preliminary Purchasing Managers' Indices (PMIs) for September, which are leading indicators of activity, were released. In the former, the manufacturing index stood at 52 points and the services index at 53.9 points, both below expectations and August's figures. In Europe, the manufacturing index stood at 49.5 points, lower than expected, and the services index at 51.4 points. It is worth noting that a figure above 50 points indicates expansion, and one below indicates contraction in activity.

In Latin America, the Central Bank of Mexico decided to cut the monetary policy rate for the tenth consecutive time, bringing it down to 7.5% from the previous 7.75%, in line with expectations. In this regard, the yield on 10-year dollar bonds rose from 5.38% to 5.39%, while the exchange rate fell by 0.2% over the week.